Tech investing in a higher rate era

Sponsored by

From rising interest rates to the prospect of an economic slowdown, tech investors have not been short of reasons for concern in the past year.

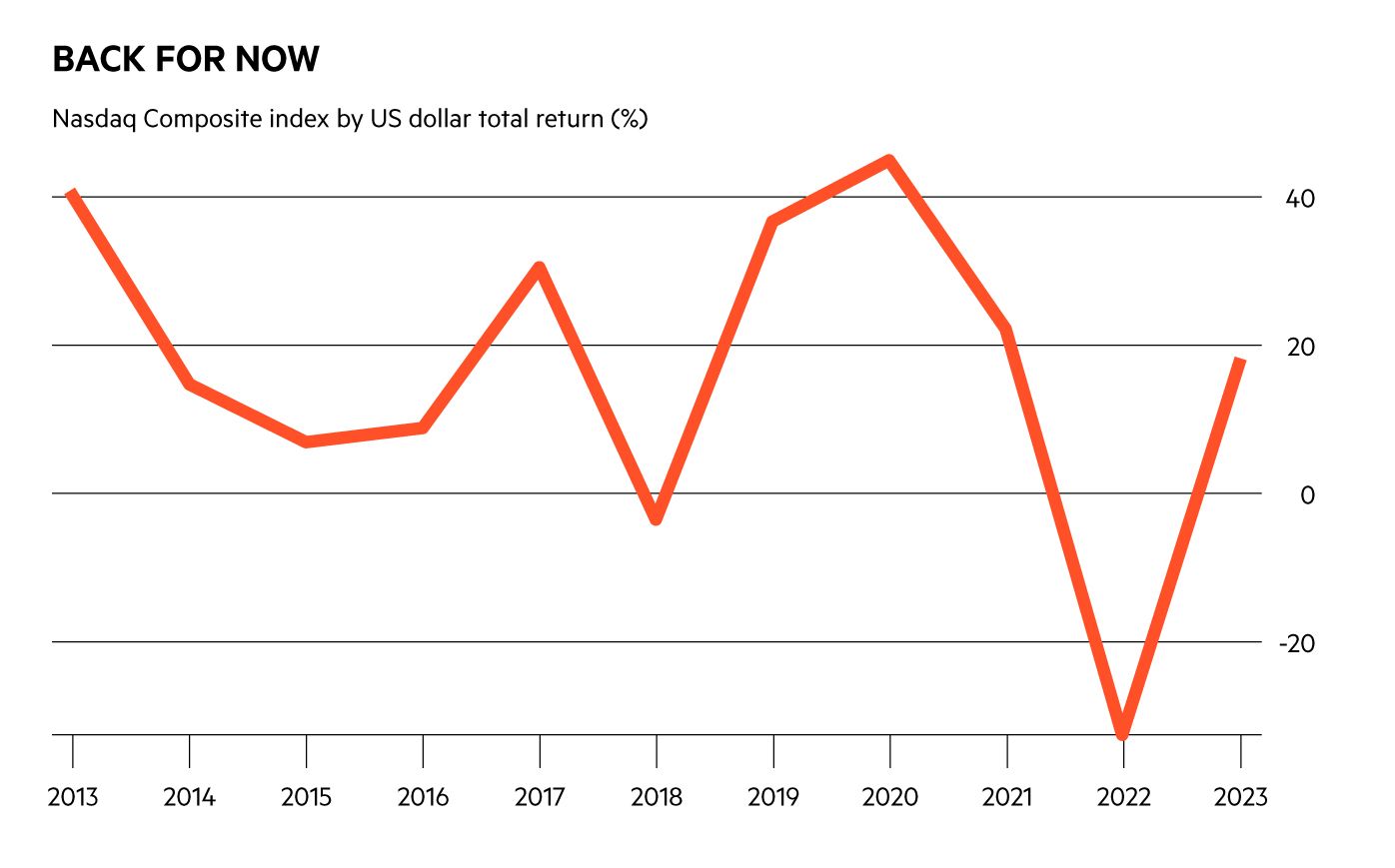

For now, some of that gloom at least appears to have abated: having lost more than 30 per cent in US dollar terms in 2022, the tech-heavy Nasdaq Composite has posted an astonishing recovery so far this year, posting a gain of more than 17 per cent in the first four months of 2023.

What’s more, the US mega-cap shares associated so closely with the tech sector’s dominance of portfolios in the past decade have recently shown greater resilience than many expected. Meta Platforms (US:META) saw a slight increase in revenue over the first quarter of the year – a pleasant surprise compared with forecasts of a decline – with rivals Microsoft (US:MSFT), Alphabet (US:GOOGL) and Amazon (US:AMZN) also coming out with positive earnings updates.

THE GIANTS versus the rest

Putting aside concerns about a higher cost of capital or economic pressures, the kind of structural growth stories that excite tech investors are still in abundance. Advances in AI in particular seem to promise a new wave of disruption and innovation, while other themes such as cyber security have not lost any of their importance. The question, as ever, centres on which companies and subsectors might be best positioned to profit from such mega trends.

The latest Investors’ Chronicle panel discussion Tech investing in a higher rate era: Constructing a profitable tech portfolio in changing times showed that, as is often the case, answering such questions can quickly become complicated.

The panellists had plenty to say in favour of the biggest names: Allianz Technology Trust portfolio manager Mike Seidenberg noted, for one, that Meta had notably improved its Reels product in the face of competition from TikTok in addition to rationalising its once substantial spending on the metaverse.

Meanwhile Ben Barringer, senior equity research analyst at Quilter Cheviot, singled out Microsoft as a major beneficiary of advances in AI thanks to its presence in internet search, software and cloud infrastructure. James Yardley, senior research analyst at FundCalibre, likewise praised Apple for its ability to perfect a product and conquer a market rather than being the initial disruptor – with the iPhone as a good example.

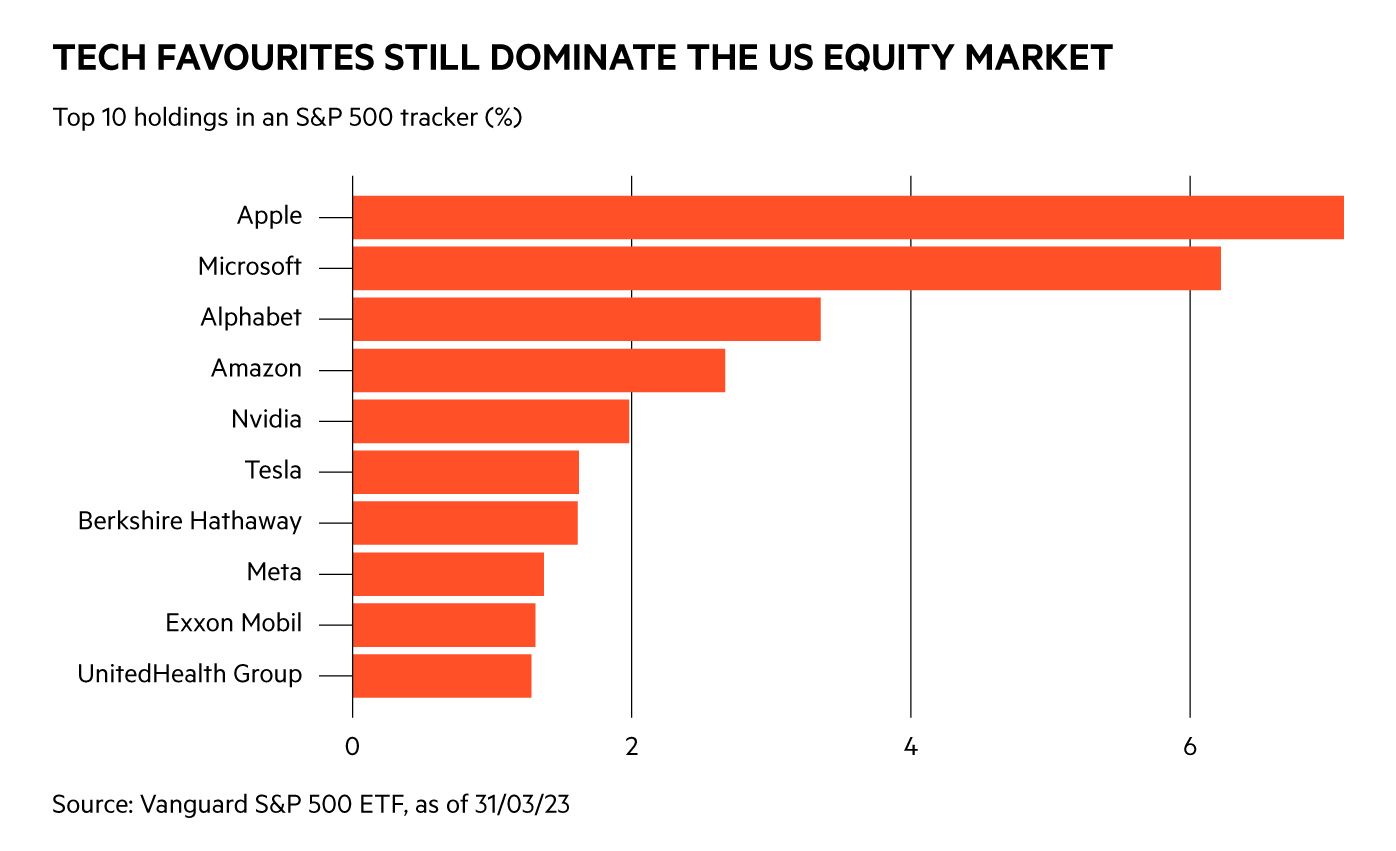

Exposure to the tech giants, be it by holding them directly, backing tech funds themselves or even using the likes of US equity trackers among others, remains an obvious way to profit from the sector’s continued disruption. However the panel pointed to good reasons not to bank too closely on the giants alone – and not to write off smaller challengers.

SMALLER CHALLENGERS

To start, the tech giants have partly improved their balance sheets via mass staff layoffs in the past year, with Microsoft alone announcing plans to shed 10,000 workers, or 5 per cent of its staff, earlier this year. Some suspect this could come back to bite them, however, with StellarOne chief executive Katharina Dalka warning the panel that tech majors would struggle to hire back staff if and when they needed them, or have to pay a big premium to do so.

On the flipside of the coin, smaller tech companies now have an opportunity to hire some of the most coveted talent in the industry on the back of such cuts. “In the smaller companies they’re seeing talent they could never get their hands on. They can pick up employess they never thought they would be able to get,” said Seidenberg.

Another challenge facing the tech majors became clear enough in recent weeks with the UK’s Competition and Markets Authority concluding that Microsoft’s planned acquisition of gaming company Activision Blizzard could substantially lessen competition in the consoles market. The CMA’s verdict, which could put the deal on ice or at least delay it, seems to show that regulators are taking a firmer stance when it comes to tech majors buying up other companies. The biggest names in the space may no longer simply be able to buy their way into a promising trend.

WHEAT AND THE CHAFf?

With a greater focus on profitability, investors may at least get greater clarity on how different tech companies are faring in a more challenging environment. However, a keen eye for a company benefiting from a promising trend rather than simply playing up to the hype is still essential. With themes such as AI, Dalka noted that this could come to looking closely at what a company might actually offer. “Without going into the tech part of it, the relevant part [of the process] is asking how is AI enhancing the business process or solving a problem,” she said.

Elsewhere panellists pointed to other companies still set to benefit from broader advances in technology – with semiconductor names such as TSMC and Advanced Micro Devices continuing to look promising.

They still face plenty of challenges – with geopolitical tensions lingering in the background among other things – but continue to stand out as one play on many a structural growth trend. Whether they prefer the tech giants or something further afield, investors still betting on the sector at least have plenty of options to choose from.

Sponsored by